Greetings! Some housekeeping notes.

This email is a “Boss Talk”, which is a segment of my ‘stack that is directed specifically to business leaders. If you’re here for my broader thinking, you can opt out of these sort of “advice-y” emails via the unsubscribe button.

I’m winding down the Summer of Failure: this’ll be the last post on this theme for a bit before we move into a less fatalistic feeling fall, though I have one more (extremely special) podcast episode in the works. Dive into the whole rabbit hole here.

Finally, a content warning: I think most of y’all probably don’t need to or shouldn’t read this. If you’ve been fantasizing consistently about what it might feel like to not have a business hanging around your neck anymore, yes, maybe. But, I don’t want to catch you on a bad day and sow heart-doubt if you’re still at it, so just be careful about over identifying with any of the below, okay?

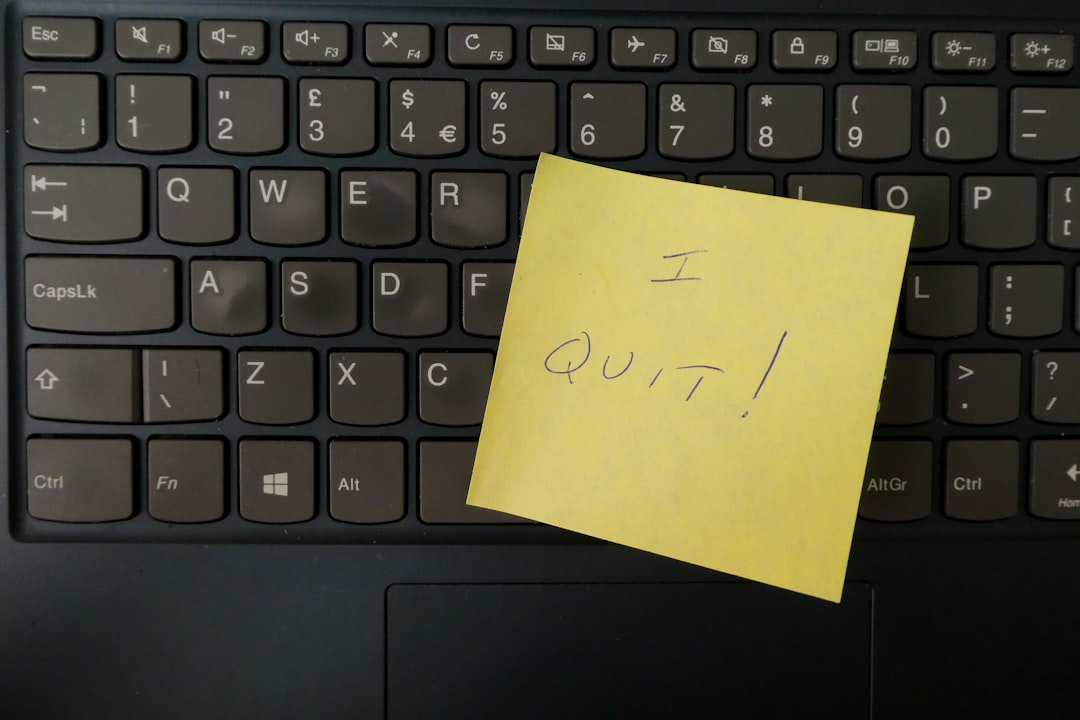

I don’t know when you should quit.

No one can really tell you that, except there are certain points of no return where you can look the other way and pretend like you don’t see the flames on the plane wings, but you’ve only got a bit of time before the thing goes into a nose dive.

So I’m going to name a few of those points. It’s more common to wait too long than to call it too early, and the longer you wait, the fewer options you’ll have.

You’re tired on a deep soul level and are having a hard time mustering the energy for the next battle.

Mostly business leadership is just decision making. All day long, every day, making decisions. Which means that businesses mostly thrive (or not) based on the quality of decision making. We talk about decision fatigue in the “Obama wore the same suit everyday”1 sense, but there’s a larger existential decision fatigue that’s pretty hard to recover from. More than any other advice I have for folks considering calling it: try and make that call with a little bit of gas in the tank.

Businesses need financial capital to grow, but they also need emotional capital: the excitement, the passion, the positive beliefs. When you run out of that, it’s pretty dang hard to keep going. Passion is a replenishable resource, what fills your tank will be unique to you, but you do have to replenish the resource.

This really is the number one, big thing…as a friend recently said reflecting on her own quitting: “What the fuck was I working myself to death for at the end of the day?” You don’t owe it to anyone to run yourself into the ground.

Your Debt Hole is too Deep.

Debt is a hole that, left untended, keeps sinking— because of interest, and also because debt needs to be filled by future post-tax profits. So I’m not talking about when lack of profit eats into a cash cushion or needing to hold a credit card balance or LOC to float a tight month temporarily. This is when you’re debt ratio has sunk so far that it’s really unlikely that you’ll recover2, because again, you need sufficient future profit to fill it. The owners that I know that have reached this point can usually feel it, and it tends to show up as the hum of anxiety in the background turning into more of a roar.

The Partnership isn’t salvageable.

You can certainly get yourself into a “staying in the marriage for the sake of the children” scenario. Partnership break ups don’t mean the business has to end, but they do mean the business in its current state has to end. Life is too short to detest the person you own a business with.

John and I are working on a series of Whiskey Fridays episodes about partnerships, stay tuned.

[ Edited to note: here’s the episode on “wonky” business partnerships: ]

An Objective Line in the Sand

Cash is more important than profit, but profit feeds your cash flow. So if you have been profitable in the past and have cash cushion, you’ll have more options than if you’ve been squeaking by with minimal or no profit. Having zero or negative profit is manageable for a bit if you have cash. But…you really really don’t want to run out of cash.

So if profit has been long term iffy…you can draw a line in the sand for yourself around your cash on hand— I mentioned this in our first Whiskey Friday episode— cash equals choice, which is why it’s better to lay your team off now and pay them severance than to keep them employed till you run out. Severance gifts your team a modicum of choice. Your line in the sand should include what you would hope to walk away with as your own severance.

More so, the line creates a mirror to expose your own waffling. If you’re dancing around that line and not doing anything decisive, at least you’ll get a periodic reminder that you’re making that choice.

If you are carrying significant debt and haven’t been all that profitable, I have to gently break it to you that it is unlikely that you’ll sell your business as a going concern. You may tend to overvalue your business (ie, how someone else will value it) because you’re so close to it, and because you will understandably hope that all the difficult work and effort might come with some reward.

One of the most gobsmackingly unfair realizations that you, an unwilling capitalist, will make is that your labor in your business isn’t worth all that much. We’re in an asset economy, people are expendable, and, absolutely, that’s fucked up.

An important aside about life context:

Each of our lives looks a bit different and I don’t think we speak enough about the extent to which that impacts the choices we have available in our economic world. For most of my career, I’ve been an economically solo person without family support, and I remember when I started out feeling flummoxed by how people were making rent, buying groceries, etc… without ever paying themselves.

Well, some of those people had partners with salaries, or generous parents, or a bunch of savings, or whatever; it’s just to say that the full context really matters.

Finally:

You don’t owe your team / your customers / your clients your vital life force.

You are allowed to value yourself more than your business, your team, and your customers.

You are allowed to stop doing things just because you don’t want to anymore.

“Failure” and endings are natural parts of the cycle of life, not a referendum on your worth or value as a human being.

If you read all this and feel some unwanted and panicked recognition, check in with yourself if you’re in the “need a big shakeup” place and not in the “jump out of the plane” place:

When you need something different.

There’s a rumbling undercurrent, that you might catch if you’re paying attention (or, like, happen to be in daily conversation with small business owners): we’re experiencing a wave of small business closures and upheaval. The pandemic isn’t over and neither is the shakeup of the economy.

👉 This post is public so feel free to share it.

Yes, there’s some deeply sexist shit to unpack here. Can you imagine Michelle getting away with wearing the same dress to every state dinner for 8 years?

Debt ratio = Total Debt / Total Assets. Without writing a business finance treatise, the best analogy for a bad debt ratio is an underwater mortgage. When the amount you owe is worth more than the house itself, you lose your leverage on that asset.